north dakota sales tax refund

The sales tax is paid by the purchaser and collected by the seller. Wednesday December 29 2021 - 0100 pm.

Where S My Refund Of North Dakota Taxes

North Dakota Sales Tax Filing Address.

. Learn more about E. In North Dakota were on track for processing state returns and refunds. Remember E-Filing is fast safe and easy.

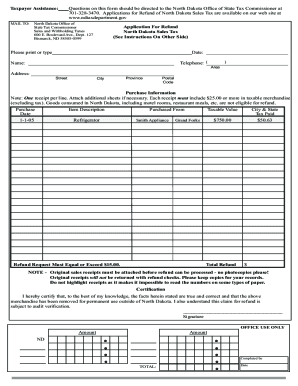

This news is specific to federal taxes. If you own an iOS device like an iPhone or iPad easily create electronic signatures for signing a north dakota sales tax refund in PDF format. 127 Bismarck ND 58505-0599 If you have additional transactions to report list on separate schedule and attach to Claim for Refund.

How to make an eSignature for the North Dakota Tax Refund For Canadian Residents Form on iOS devices. Local lodging local lodging and restaurant alcohol tobacco excise taxes etc. Write your name and contact information into the corresponding form-fields.

Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST. Ndgov Cory Fong Tax Commissioner NNoticeotice Sales Tax Request For Refund - Canadian Resident May 5 2009 In recent months the Tax Department has received a considerable number of sales tax refund. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be removed from North Dakota within 30 days of purchase for use permanently outside of North Dakota.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. North Dakota Office of State Tax Commissioner Sales Special Taxes 600 E.

Local Sales Tax Rate Lookup The Sales and Use Tax Rate Locator only includes state and local sales and use tax rates and boundaries for North Dakota. Form 306 - Income Tax Withholding Return. The state will ask you to enter the exact amount of your expected refund in whole dollars.

It does not include special taxes such as. Choose direct deposit for the quickest turn-around time To track your refund go to North Dakotas Income Tax Refund Status page. Questions regarding the refund of tax may be directed to.

Sales Use and Gross Receipts Tax Return to the following address. Form 301-EF - ACH Credit Authorization. The North Dakota Office of State Tax Commissioner would like to reach out to taxpayers regarding news you may see about returns and refunds being delayed on a national level.

Click Claim for Refund of City or County Sales and Use Tax. North Dakota sales tax payments. Refunds Things to Know.

Income Tax Withholding Forms. How can we make this page better for you. The claim for refund must include copies of all invoices to support the claim.

Gross receipts tax is applied to sales of. The North Dakota Office of State Tax Commissioner is pleased to announce the launch of its new website wwwtaxndgov. Written Determinations Sales and Use Tax.

North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD. New farm machinery used exclusively for agriculture production at 3. Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically.

PO Box 25000 Raleigh NC 27640. Go online to the North Dakota state governments Sales and Use Forms and Instructions page linked in the Resources section. Ad Have you expanded beyond marketplace selling.

Amended Returns and Refund Claims. North Carolina Department of Revenue. Over 480000 individual income tax returns were filed in North Dakota for tax year 2020.

North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search for a. Refund statuses are updated daily. With the launch of the new website also comes the release of the 2021 North Dakota income tax booklets and income tax forms and the 2022 income tax withholding tables.

Furthermore refunds are available only on taxable purchases of 2500 or more. North Dakota sales tax is comprised of 2 parts. A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E.

How to File Sales and Use Tax Resources. Refund Applied to Debt North Dakota participates in income tax refund offset which provides that an individual income tax must be applied to reduce a debt you may owe to a state or federal agency. 127 Bismarck ND 58505-0599.

Copies of all invoices must accompany your request. MOTOR VEHICLE TAX REFUND North Dakota Department of Transportation Motor Vehicle SFN 2883 3-2016 MOTOR VEHICLE DIVISION ND DEPT OF TRANSPORTATION 608 E BOULEVARD AVE BISMARCK ND 58505-0780 Telephone 701 328-2725 Website. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. Avalara can help your business. Applicants Legal Name Title Number Mailing Address City State Zip Code Vehicle.

Over 90 were filed electronically. Download and print the PDF document. Sales and Use Tax Revenue Law.

Office of State Tax Commissioner. SignNow has paid close attention to iOS users and developed an application just for them. Office of State Tax Commissioner.

North Dakota Tax Forms And Instructions For 2021 Form Nd 1

Burgum Signs 350 Income Tax Credit Bill

Ndtax Department Ndtaxdepartment Twitter

Sales Use Tax South Dakota Department Of Revenue

Do I Have To File State Taxes H R Block

Ndtax Department Ndtaxdepartment Twitter

North Dakota Tax Refund Fill Online Printable Fillable Blank Pdffiller

How To Register For A Sales Tax Permit In North Dakota Taxvalet

North Dakota Tax Refund Fill Out And Sign Printable Pdf Template Signnow

North Dakota Nd State Tax Refund Tax Brackets Taxact

North Dakota Sales Tax Small Business Guide Truic

Apply For Your Sales Property Tax Refund South Dakota Department Of Revenue

South Dakota Student Loan Forgiveness Programs

North Dakota State Tax Software Preparation And E File On Freetaxusa

South Dakota Self Directed Ira

Income Tax Update Special Session 2021